The Partnership for Carbon Accounting Financials (PCAF), created in 2015, is a global coalition of financial institutes that collaborate to assess and disclose the Greenhouse Gas (GHG) emissions associated with investments.

PCAF offers a standardized set of guidelines for measuring and reporting financed emissions used by over 550 financial organizations.

PCAF has faced several limitations, challenges and criticisms:

- Data Quality and Availability: One of the primary challenges for financial institutions using PCAF is the quality and availability of data. Entity- or investment-specific data is often not easily accessible. This can lead to the use of estimated or proxy data. While PCAF provides guidance on managing these limitations, the reliance on such data can affect the accuracy of emissions reporting, particularly on Scope 3 emissions.

- Market Value Fluctuations: PCAF’s reliance on market value to apportion emissions, can be impacted by market fluctuations. This can affect the consistency and reliability of emissions calculations.

- Governance Complexity: The complexity of the accounting approaches required together with data sources and the range of impacted stakeholders necessitates extensive board-level oversight. This can be a significant challenge for financial institutions, especially those with less experience in climate-related reporting.

- Voluntary Nature and Underreporting: Critics, including climate finance activists like ShareAction and Greenly, have raised concerns about the voluntary nature of PCAF. The lack of regulatory oversight and the potential for financial institutions to set their own standards could lead to underreporting of emissions. Without the involvement of regulators and scientists, the rigor and credibility of the standards are questioned.

- Weighting of Capital Markets Activity: There is significant variability in how much weight is applied to capital markets activity in facilitated emissions, ranging from 17% to 100%. This inconsistency can lead to under-reporting of climate impact, particularly if lower weightings are adopted.

- Compliance Issues: A report by the 2 Degrees Investing Initiative found that not a single signatory was fully compliant with the PCAF standard. This highlights the challenges financial institutions face in meeting the rigorous requirements of the standard.

These limitations and criticisms underscore the ongoing need for improvements in data quality, regulatory oversight, and standardization to enhance the effectiveness and credibility of PCAF in the financial sector.

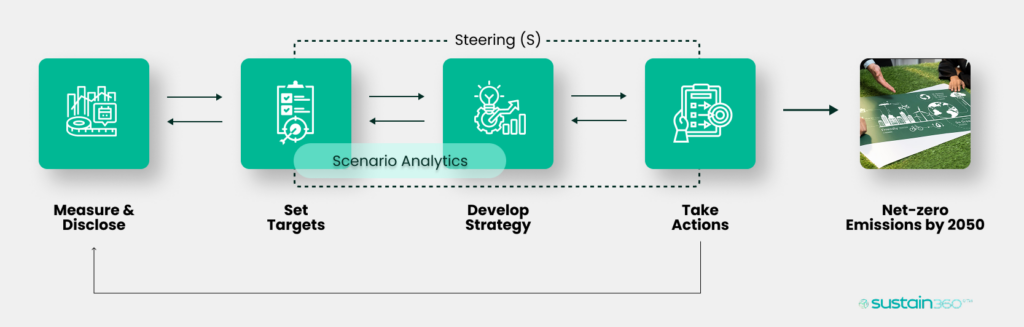

How can Sustain360™ help?

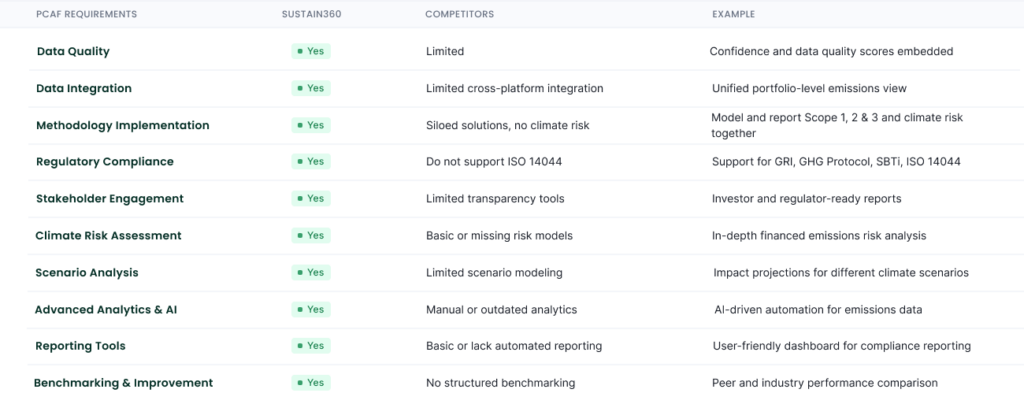

Sustain360™ is a comprehensive sustainability software platform that can financial institutions, navigate and overcome the limitations of the Partnership for Carbon Accounting Financials (PCAF). Here’s how Sustain360™ can provide assistance:

By leveraging the expertise and resources of Sustain360™, financial institutions can more effectively address the limitations of PCAF and enhance their overall sustainability performance.